Insights

Proprietary market data, research and analysis

Quant Insights

Crypto: Digital gold or fools gold?

In this Quants Corner, we will isolate the return profiles for major cryptocurrencies and see if they provide a sufficiently strong foundation for...

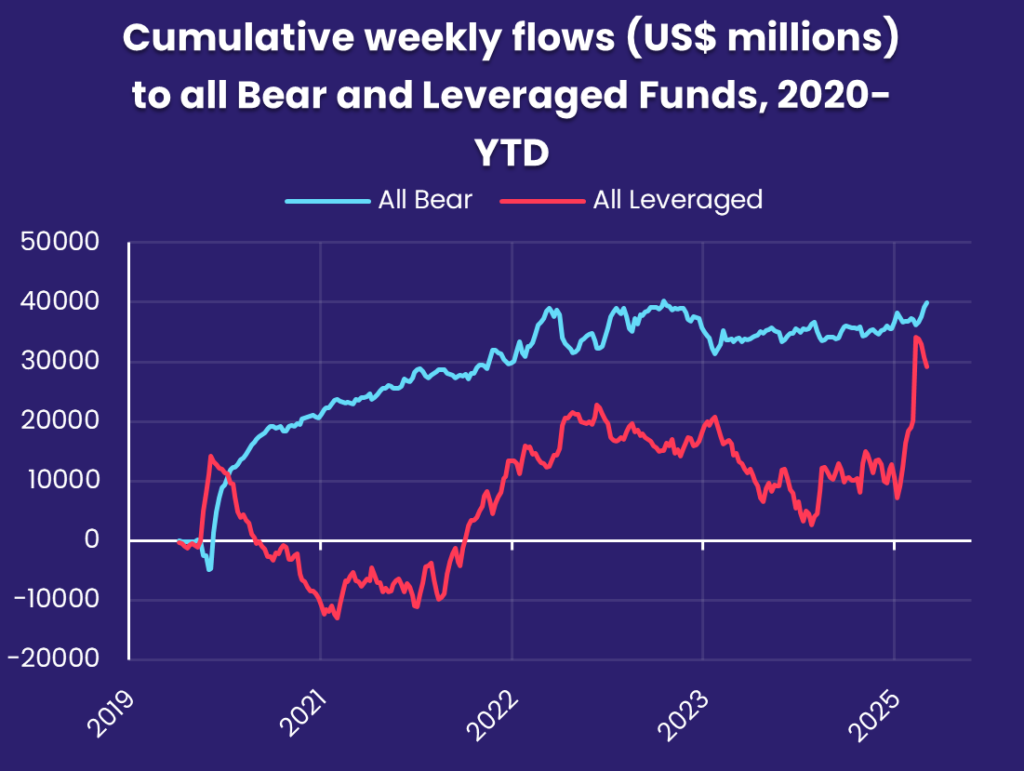

Playing with dynamite

In this Quant’s Corner, we will look at the growing number of single-security Leveraged Funds in EPFR’s database and explore ways to generate...

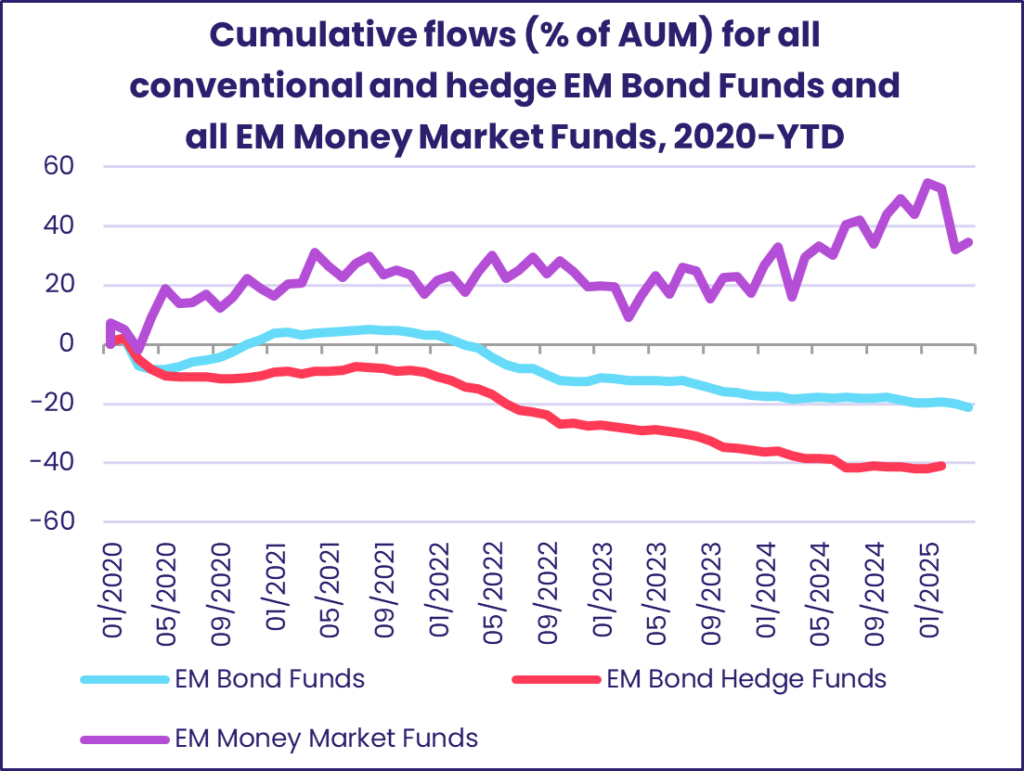

CLOs emerging from the CDO shadow

Modern CLOs and CDOs are regarded as much safer than their pre-crisis versions. But where, in the spectrum of major fixed income asset classes do...

Economist Insights

For fund flows, back to the future?

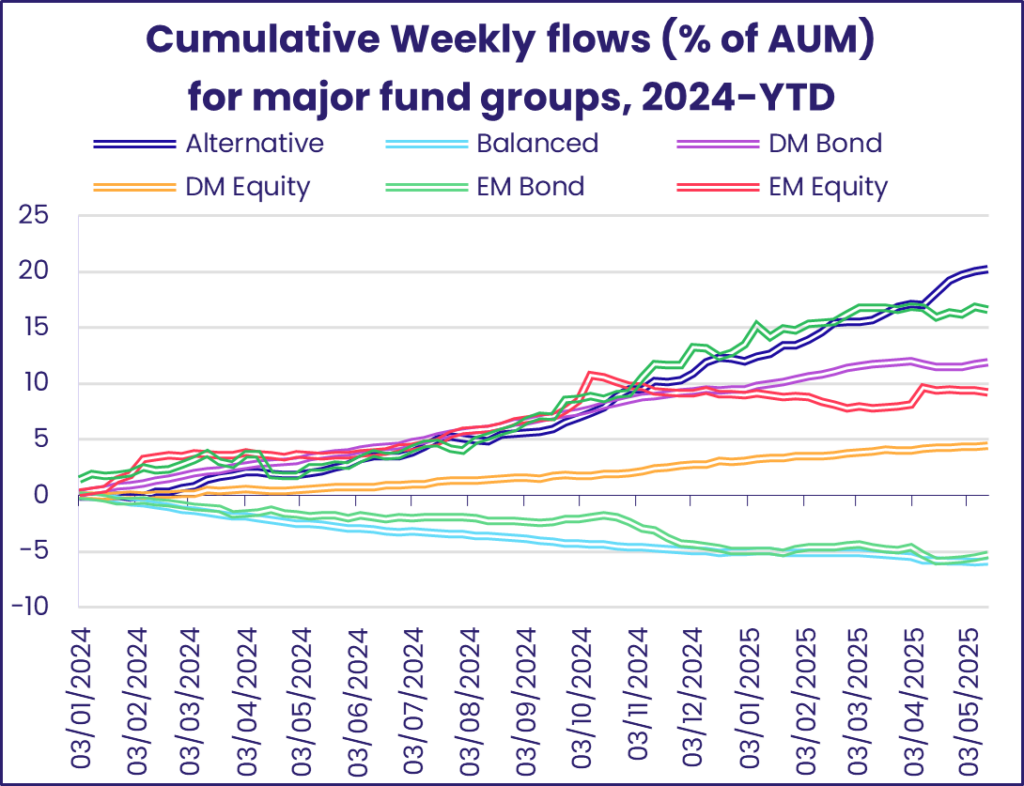

Flows to EPFR-tracked funds during the second week of May had a pre-Liberation Day look as US Equity Funds snapped their longest run of outflows...

Investors bear down on slower growth

For EPFR-tracked mutual funds and ETFs, May began much as the previous month ended. Investors again bypassed US and China Equity Funds in favor of...

Will US policy respond to reality’s bite?

The final week of April saw the release of data showing the US economy stalled in the first quarter, new orders for Chinese exporters fell to a...

Multimedia

Flows and Trends: “Liberation Day” and After

Our latest on-demand video – “Liberation Day and After” – unpacks the implications of rising tariffs on markets, investor expectations and central...

“Liberation Day” and after: A remarkable period of volatility for global fund flows

The Trump administration’s tariff announcements in the first week of April triggered the worst turmoil in global markets since the pandemic.

Latin America’s Macro Landscape: Divergent Economies and Complications from Trump

Latin American nations boast a wealth of natural resources and growing middle classes. They are also vulnerable to US tariffs, the ups and downs of...

Papers

EPFR Papers: Estimating asymmetric price impact

This paper studies the asymmetric price impacts mutual fund and ETF flows have on individual stocks in demand-based asset pricing.

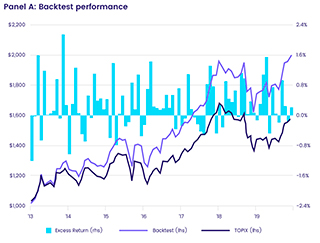

A rising tide lifts some (Japanese) boats: The Bank of Japan’s ETF purchases and their impact on market signals for individual stocks

The Bank of Japan has been the pace-setter among central banks when it comes to purchasing non-government financial securities. It was the first...

Oil bonds still have fuel in the tank – but how long will it last?

Fixed income markets are abuzz about the spectacular demand for new green bonds. Flows into fixed income funds with socially responsible investing...